4 Steps to Figuring Out ROI on Digital Content

Written by Matt Clement

April 28, 2016

Most of us are familiar with investments. If you have a portfolio, a 401(k), or even a savings account, you can consider yourself in some way, shape, or form an investor. The strategy: put money in and walk away with more money than you started with. As Kevin O’Leary from Sharktank says, “I want to go to bed richer than when I woke up.” So, what does this have to do with my digital edition….my website….my Facebook account….you ask? Well, really nothing and everything at the same time. Because, ROI.

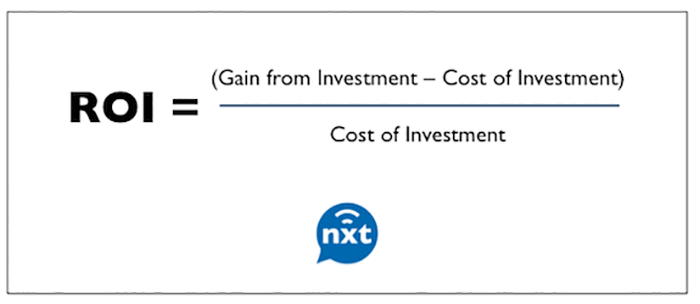

ROI (return on investment) is calculated as:

It’s really a simple equation. If I throw $100 into ABC stock today and a year later it’s worth $120 then my ROI on that $100 is 20%. That doesn’t seem too complicated. However, in a perpetually evolving digital world with all of the different platforms, channels, and metrics available, figuring out ROI becomes a little bit more complex and can seem like a daunting task. You still want to walk away with more money than what you put in though.

As daunting a task as this may seem, I want to assure you that there are some steps you can begin to take toward calculating ROI and gaining a better handle on the value of your efforts. Whether you’re a publisher looking to drive subscriptions, an association with goals of increasing membership, or an enterprise selling a product, knowing ROI of your campaigns can help you to be more efficient and successful.

Step One: Determine What You Want to Accomplish

The first step to calculating ROI is to define what it is that you’re looking to accomplish. What outcome do you want from your readers or visitors? What is the end goal? These are known as conversion goals.

A conversion goal can be a purchase, a completed form/survey, a click-through of some sort, a certain amount of time spent with content, a share….the list goes on. The good news is that you have the power to define these! The not-so-good news is that every organization’s conversion goals are different and there’s no cookie-cutter approach. Once you’ve got your conversion goals clearly laid out and defined, you’re ready for the next step, metrics!

Step Two: Choose Your Metrics

The next step is choosing the metrics that best measure your conversion goals. If your conversion goal is a reader filling a form out, there are several metrics that can be tracked (overall visits, form specific page visits, time spent, link clicks to form, form completions). By using these metrics you can begin to answer some important questions.

- What percentage of readers that visit the book are visiting the page that the form is on?

- How much time are they spending on that page?

- Are they finding the link quickly?

- How many readers are clicking through to the form?

- How many actually filled out and completed a form?

When you’re analyzing metrics to track your conversion goals, it’s important to understand and incorporate metrics from all of your different channels. It’s not uncommon for our clients to have five or more channels (ie. digital publication, website, blog, email, social). You need to understand how these channels interact with one another because measurement of conversion goals often overlaps from one channel to another.

Step Three: Determine the Monetary Value of Your Conversions

In order to track the revenue part of your ROI equation, you need to determine the monetary values of your conversions. This can seem complicated as some conversions are easier to apply a monetary value to than others. For instance, the price of a subscription, membership, or product is easier to value than a form completion, click, or share. It’s important that you figure out values for your conversions as it’s the only way you’ll be able to calculate ROI for certain campaigns. If you have no idea where to start, experts will tell you to think hard and ask yourself or your team questions such as these:

- If a reliable and trustworthy person were to promise you 100 clicks, how much would you be willing to pay per click?

- If that reliable and trustworthy person were to promise 10 completed surveys/forms, how much would you be willing to pay per survey/form?

It’s important to keep in mind that these completed conversions may not be sure things. As I’m sure you’re acutely aware, nothing is ever 100%, so it’s important to keep it in perspective and view these leads, contacts, sign-ups, or whatever they mean for your business as average potential. Remember, you can always adjust your values once you’ve been around the block a few times.

Step Four: Track and Determine Your Costs

Once you’ve got some values set for your conversions and returns you’ll need to track and determine your costs. Remember, your cost should include time and energy spent in addition to hard monetary expenditures. If you’re running a Facebook ad, you’ll want to include the cost of content development and/or design hours for the creative in addition to what Facebook charges you.

If you’ve made it this far, congratulations! You can now start to determine the ROI of your hard work. It’s helpful to chart out each campaign, list successful conversions, associated costs and place a total value on what each campaign has netted you. Having a handle on ROI will help you and your organization make sound decisions and allocate resources. Being able to talk in terms of ROI can also help when presenting to a board or selling advertising space.

If there’s one closing remark that I feel is imperative, START SMALL! You’re going to overwhelm yourself if you try to implement too much at once. Start with a few simple conversion goals and build your expertise from there. Set an attainable timeline. It can take anywhere from a few months to a few quarters (or years) for an organization to figure these things out. Don’t be afraid to fail and be patient. You’re not going to be a marksman if you’re defining conversion goals, values, and costs for the first time. It’ll take some trial and error, refinement, and time to get in a good groove. But, if you keep at, you’ll become an ROI expert soon enough!